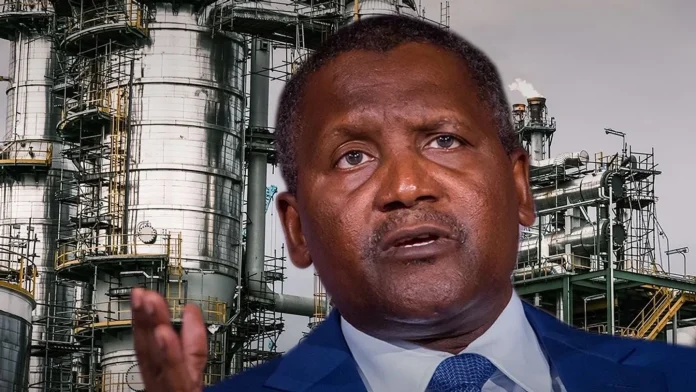

The President of Dangote Group, Alhaji Aliko Dangote, has revealed plans to sell between five and 10 percent of the Dangote Petroleum Refinery’s stake on the Nigerian Exchange (NGX) Limited within the next year.

Dangote disclosed this in an interview with S&P Global, noting that the move aligns with the group’s strategy for other listed subsidiaries, including Dangote Cement and Dangote Sugar RefRefinery.

Read Also: Dangote Refinery steals spotlight as Dangote Group marks Special Day at Abuja Trade Fair

Read Also: Dangote to raise 50 entrepreneurs through farmers empowerment program

“We don’t want to keep more than 65% to 70%,” Dangote said, adding that the shares would be offered gradually, depending on market depth and investor appetite.

According to him, the group is also exploring strategic partnerships with Middle Eastern investors to support the refinery’s expansion and develop a new petrochemicals project in China.

“Our business concept is going to change. Instead of being 100 percent Dangote-owned, we’ll have other partners,” he explained.

Daily Trust reports that on the Nigerian National Petroleum Company (NNPC) Limited’s interest, Dangote noted that while the company’s stake had reduced to 7.2 percent, there could be room for further discussions once the refinery enters its next growth phase.

“I want to demonstrate what this refinery can do, then we can sit down and talk,” he added.

Meanwhile, the industrialist confirmed plans to expand the refinery’s capacity to 1.4 million barrels per day (bpd) — a scale that would surpass the world’s largest 1.36 million bpd refinery in Jamnagar, India.

S&P Global reported that the refinery initially planned to expand from 650,000 bpd to 700,000 bpd by the end of 2025, but the new long-term target doubles that figure.

Dangote also disclosed that the company is developing linear alkylbenzene and base oils projects while aiming to increase polypropylene output from 1 million to 1.5 million metric tonnes annually.

On operational updates, he said most of the refinery’s technical issues had been resolved but confirmed a planned one-month maintenance shutdown for the Residue Fluid Catalytic Cracker (RFCC).

“We have resolved most, not all, but most of the problems. We’re looking for a window to shut down for about a month,” he said, assuring that the maintenance would be scheduled to avoid clashing with the year-end surge in fuel demand.